Resilience of Infrastructure

Introduction

The UK Government held a consultation from July to September 2021, in which it sought public views to inform the development of a new National Resilience Strategy that will outline an ambitious new vision. The consultation sought to understand current perceptions of risk and resilience, gather evidence on where improvements could be made, and gauge the UK's appetite for change. Six themes were identified for comment:

- risk and resilience

- responsibilities and accountability

- partnerships with non-public-sector bodies

- community, a whole-of-society approach

- investment and where to place it

- resilience in an interconnected world

The Institution of Civil Engineers responded, supported by risk expertise from the Institute and Faculty of Actuaries (IFoA)[1]. This article highlights the key insights from the IFoA evidence.

Actuaries have always been expert in the management of probability and long-term investment, and their vision and techniques have the potential to make a significant difference to infrastructure resilience also. Among other things they will be able to assist in visualising and analysing a wider range of future scenarios in the mediumterm and longer-term than is commonly done, leading to informed practical decisions despite all the uncertainties. Hopefully the fact that the IFoA has contributed to this evidence will alert everyone concerned to the need for actuaries to become involved to a greater extent than at present.

Techniques for assessing new projects

A vital principle for project sponsors when making resilience decisions is to focus on best value, not lowest cost, since desirable resilience measures may sometimes increase cost. Best value is the optimum cost which provides robust and flexible performance under a wide range of future scenarios.

Several techniques can help in the identification of best value solutions:

- Adaptive Pathways - Where it would cost a great deal of extra money to make new infrastructure fully resilient against climate change or other risks, an “adaptive pathway” approach can be used to give a lower initial cost. A degree of resilience is built in, but with flexibility for resilience to be increased later if the risk grows. This approach has the great advantage of avoiding initial extra expense which might turn out to have been wasted if the risk does not grow as much or as quickly as anticipated or if technological innovations elsewhere shorten the asset’s useful working life.[2]

- Extreme Events - For studying extreme events, probabilistic techniques can be used to evaluate frequencies, timings and impacts. For example, we can take a set of observed extreme events (such as maximum temperatures over the last 100 years) and identify any trends in order to estimate the probability of a given maximum (possibly greater than any experienced in the past) occurring within specified future time periods.

- Foreseeable disaster risks - Known risks of future disasters should be given special attention and exploration in depth. Given the catastrophic impact if such events occur, it is important to treat estimates of a low probability of occurrence with caution, because such estimates may well turn out to be wrong. Resilience measures should therefore be adopted for foreseeable disaster risks as far as reasonably possible, even if this involves extra cost.

- Connected systems - There is also a wider point that for connected systems of infrastructure, resilience needs to be studied for the system as a whole, as well as for the component parts.

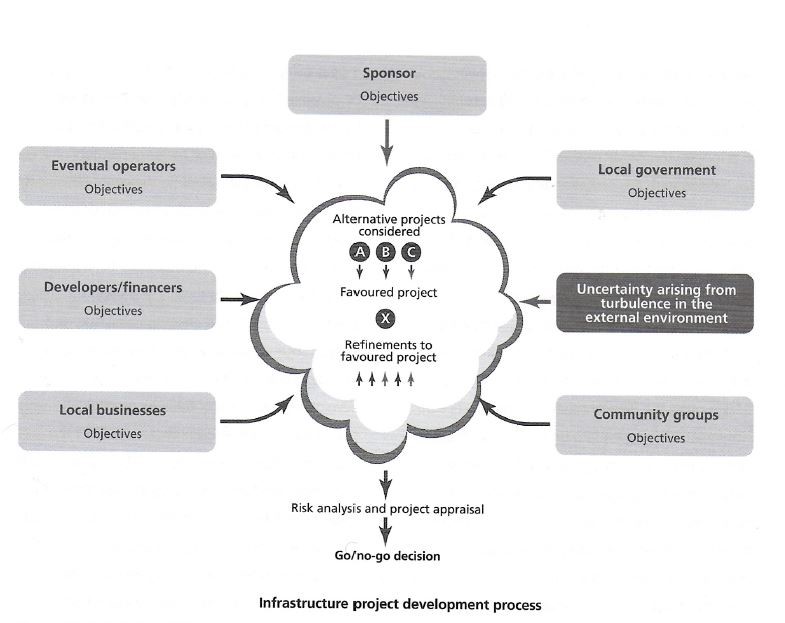

Source: Risk Analysis and Management for Projects - a strategic framework for managing project risk and its financial implications, 3rd edition (2014), published for the Institution of Civil Engineers and the Institute and Faculty of Actuaries

Existing infrastructure

Much of the infrastructure which will be used in the next 50 years already exists, and in some cases, it was constructed a long time ago. Our evidence recommends the establishment of a new system of resilience assessments of fixed physical structures, which could create an invaluable data base to indicate where action is needed. In the case of critical national infrastructure, we recommend that the Government should undertake advance planning of possible supply chain shortages and ensure the maintenance in the UK of sufficient stocks of supplies to cope with exceptional situations.

Public-Private Partnerships

Our evidence suggested that there is considerable scope for more co-operation on resilience between public authorities and private investors. An official Resource Centre (to be set up by the Government or the National Infrastructure Commission) could ensure the provision of high-quality data and information to investors about resilience actions. Tools could be recommended for reporting on such matters as Environmental, Social and Corporate Governance (ESG), resilience status, and social aspects, in such a way as to achieve consistency of reporting between investors.

|

We recommend that for each new project, the sponsor should publish a Resilience Statement for users and prospective investors, which would summaries the significant risks to which the project is exposed and give the sponsor’s views on the likelihood, timescale and impact of each risk. At a practical level, investors can often make more use of existing physical assets which are becoming “tired” or under-used, for example by refitting and/or repurposing existing real estate, in co-operation with local authorities. This can provide climate resilience, environmental benefits, and improvements to biodiversity and human well-being. |

There are several recent investments that have utilised a blend of private investment / contributions with LEP (Local Enterprise Partnership) investment plus multi-Government department and Local Authority funding to improve investments. These include: ▪ The largely privately funded Bacton Gas Terminal sandscaping scheme to help secure 25-30% of the UK gas supply plus deliver wider regional infrastructure benefits. ▪ The Lowestoft tidal barrier flood risk management scheme, that will deliver a flood resilience project in a privately owned port while it remains operational, supporting the offshore energy operations and enabling other government investments to be resilient (such as major transport and regeneration projects), protecting jobs and supporting the creation of additional employment and economic growth. |

New kinds of partnership between public and private investors in infrastructure could enable investors to help in the achievement of resilience, including the resilience of the “social” infrastructure which is connected to an income-generating asset. More attention also needs to be paid to natural infrastructure. In urban areas this includes rivers, parks, green roofs, sustainable drainage systems, street trees, roads, pathways, cycle paths, allotments, etc.

Investors will increasingly think of resilient infrastructure as “a sustainable integrated infrastructure system, which supports social and community needs both in normal times and in times of crisis.”

It is possible to glimpse a future where the public and private sectors increasingly work together to improve the resilience of both economic and social infrastructure within an integrated infrastructure system.

Conclusion

There is more in the evidence itself than can be summarised here, including much of great interest from the civil engineers. It is clear that some radically new approaches to resilience can and should be considered, given the wide range of uncertainty about the speed and impacts of climate change, uncertainties about the physical state of some existing infrastructure, and the possibility of rapid technological advances which might make some infrastructure assets prematurely obsolete.

_______________________________________________________________________________________

[1] The evidence submitted on behalf of the two organizations can be found here: ICE submission on the

National Resilience Strategy | Institution of Civil Engineers

[2] Analysis of adaptive pathway options can be done using an actuarial model employing discounted cash flow techniques, probabilities and a wide range of future scenarios. See worked example at

Resilience Assessment Methodology 14Nov2019.pdf (actuaries.org.uk)

Chris Lewin is the chairman of the Infrastructure Working Party of the Institute and Faculty of Actuaries, which studies the risks and returns from investing in infrastructure and recently considered how investors can improve resilience.

The views and opinions expressed in this blog are those of the author and do not necessarily reflect those of the Coalition for Disaster Resilient Infrastructure (CDRI).

.jpg)

.jpg)