|

|

|

Physical Climate Risk Assessment Methodology (PCRAM)

Introduction

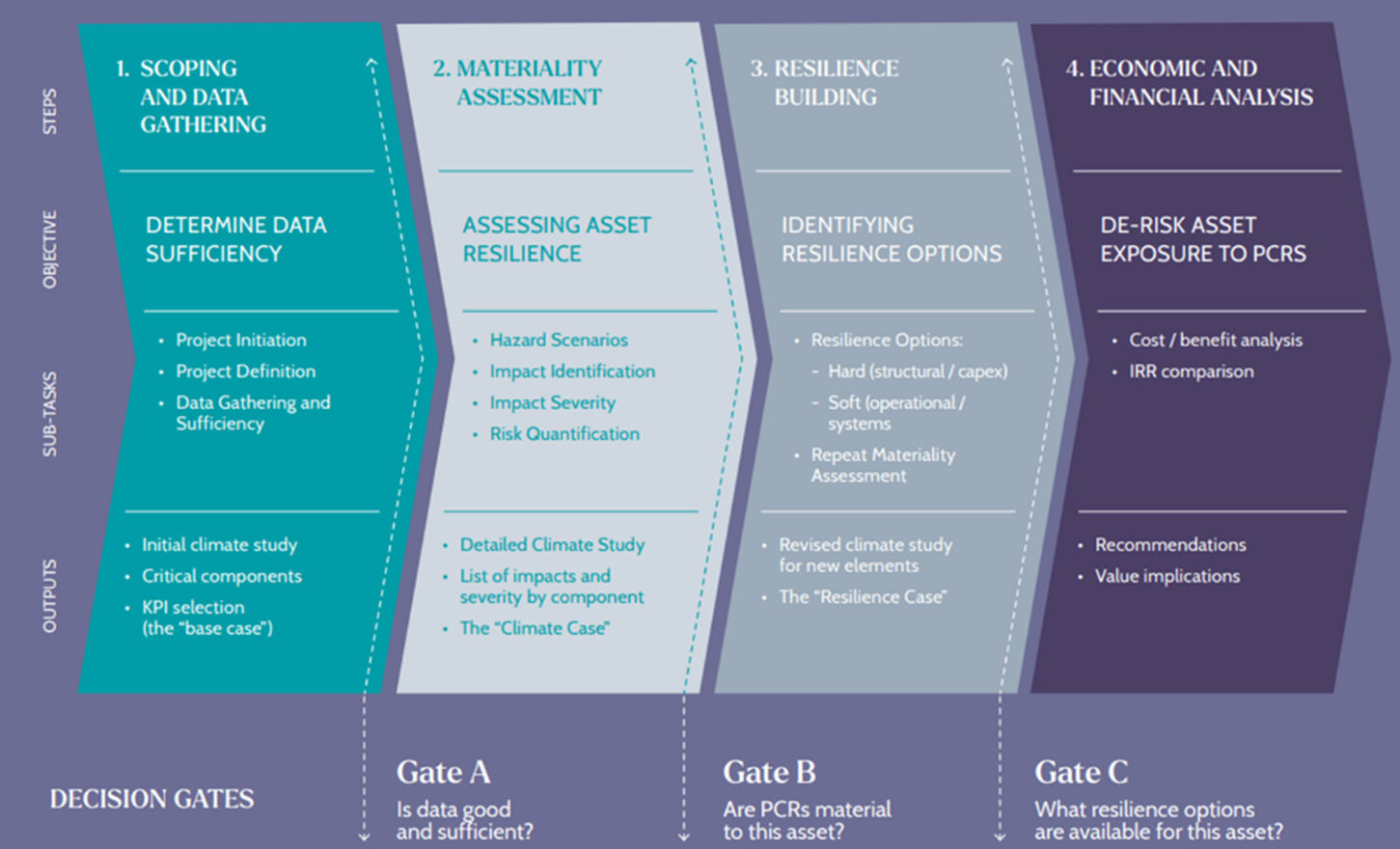

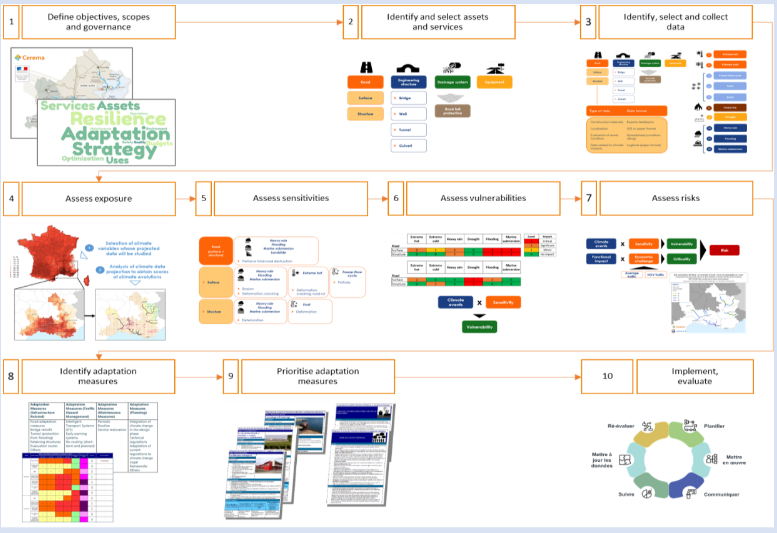

In response to growing demand from investors for comprehensive solutions for improving the integration of physical climate risks (PCRs) into investment appraisal practices, CCRI and Mott MacDonald developed the PCRAM, to bolster the case for investment in infrastructure resilience.

New infrastructure investments are designed/re-designed to (a) understand the financial benefit of making these changes and (b) to adjust the original design to meet future climate risks. PCRAM provides a best practice example of a method to integrate physical climate risks in infrastructure investment appraisal.

About the Initiative

Infrastructure systems must become resilient against climate change if they are to be sustainable. Owners, operators, and investors need to have confidence that infrastructure can withstand and recover from the extreme weather that is becoming increasingly frequent, in a way that minimises disruption and repair costs and protects its performance. Users need to know that they can rely on the vital services these systems provide. And yet, investment in infrastructure resilience lags well behind what is needed. Part of the reason for this has been a lack of evidence about where and how to invest. But this is now changing, with tools and data available to help measure and manage risk.

The Coalition for Climate Resilient Investment’s Investor Solutions workstream aimed to build the financial case for resilient investments. The result is PCRAM, which is an open-source resource created for the public good, to improve consistency in risk assessment and provide a common language between the infrastructure and financial industries. PCRAM is the first methodology of its kind, developed using real world case studies and rigorously reviewed by leading experts from a range of industries.

PCRAM brings together climate science, asset management, resilience practitioners and financiers to assess, design and quantify the resilience needs of infrastructure assets. It can be used to identify material physical climate risks to an organisation’s assets and build resilience to improve performance and protect revenue. PCRAM helps decision-makers understand benefit-to-cost ratio, target investment, and plan programmes of investment that align with existing organisational and regulatory investment cycles. The methodology can be applied to any physical asset or portfolio of assets, for any set of climate hazards. It is designed to enable owners and investors alike to develop their level of maturity in managing climate risks over time. PCRAM allows asset owners and operators to invest strategically and confidently to protect their assets and businesses from climate change.

Learning & Impact

The PCRAM guidance captures many of the lessons learned that were discovered during the development of the PCRAM method. In summary, PCRAM demonstrates how genuine industry collaboration can bring about public good and widespread orientation towards infrastructure resilience. Impressively, through CCRI’s leadership, PCRAM brought together a diverse mix of organisations to contribute to the development of this tool including, engineering, capital providers, academic institutions, standards agencies, climate data providers and international organisations. This diverse mix of organisations contributed to the success of the method as it provides a much-needed common language across the industry.

In addition, there are several challenges with this exercise, which are summarised below:

- It is difficult to determine both the quantum and the timing of changes to revenues and costs associated with each resilience options, as these may be untested and could also depend on the timing of occurrence and/or severity of a specific climate hazard. One way to alleviate this is to undertake a Monte Carlo-type analysis. Another way would be to utilise climate damage curves, which are a simplified expression of impacts and damages (e.g., monetary or downtime impacts) as a function of climate hazard severity.

- The impact of changes to cash flow forecasts in the long run are reduced by the time value of money, which makes changes to Internal Rate of Returns (IRRs) more sensitive to shorter-term events and adjustments.

- There still is a debate on adjustment to discount rates in relation to climate risks. As an asset becomes more resilient through incremental investments and/or the implementation of non-structural measures, its cost of equity should theoretically be reduced. The methodology for adjusting a project discount rate is however still under development, which is the reason why this tool has not focused on changes in Net Present Values to compare resilience options.